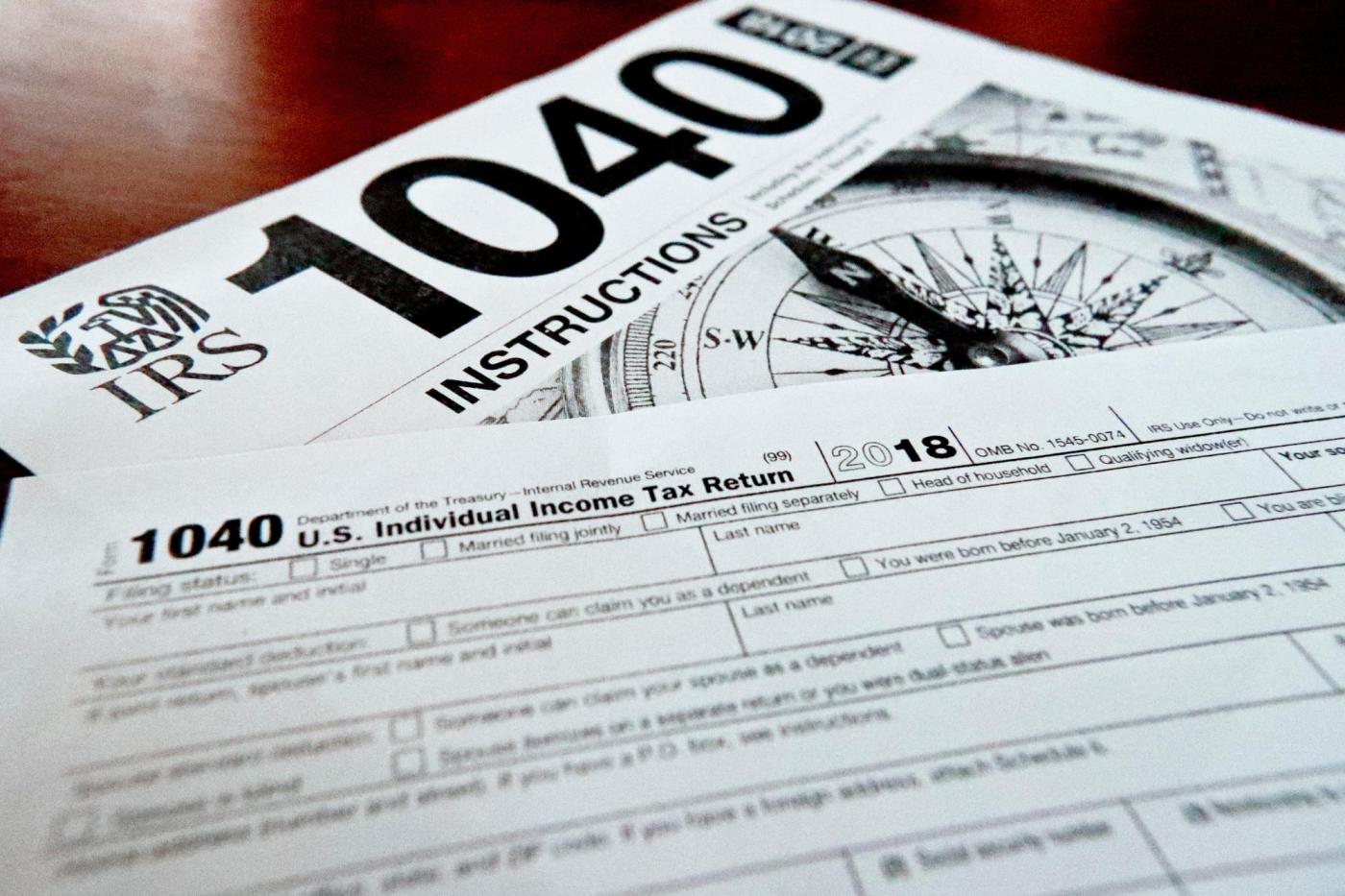

2025 tax season is here. More people can file online for free

Tax season has officially opened. Starting on Monday, you can now file tax returns for 2024 income.

This year the Internal Revenue Service is making it easier for more people to file online for free, through its Direct File program. That was introduced last year as a pilot, and this year it is being expanded.

Last year, only people claiming any of three credits could file using Direct File. This year, you can use Direct File if you’re claiming any of seven credits:

Earned Income Tax Credit

Child Tax Credit

Credit for Other Dependents

Child and Dependent Care Credit

Premium Tax Credit

Credit for the Elderly and Disabled

Retirement Savings Contribution Credits

The program’s software is also upgraded, the agency said in a news release.

“Similar to commercial tax software, a data import tool will allow taxpayers to opt-in to automatically import data from their IRS account, including personal information, the taxpayer’s IP PIN and some information from the taxpayer’s W-2,” it said.

The agency introduced Direct File last year as a pilot in 12 states, including California. This year the program is being expanded to cover 13 more states.

Tax credits in flux

San Diego tax attorney Adam Brewer, with AB Tax Law, said while this year does not have any seismic changes in tax law, there are two opportunities people may want to consider.

“I feel like we’re in like calm before the storm, with the new administration and lots of new proposals,” Brewer said. “But as far as the 2024 taxes that people are about to file, it’s pretty quiet.”

If tax credits for residential solar panels are not extended, that will change the incentives around making this investment. (K.C. Alfred / The San Diego Union-Tribune)

Related Articles

File taxes online: Tools, tips, deadlines and more

IRS sending automatic stimulus payments. Are you on the list?

Opinion: The case for killing the tax credit for electric vehicles

Editorial: Unjustified $2.50 Bay Area bridge toll hike, murky accounting should prompt state audit

As 7 state tribes sue their gambling rivals, San Jose and other Bay Area cities could be the losers

One area is the EV tax credit, which may be curtailed as legislative priorities shift under the new Trump administration, he said.

“If you were going to buy an EV anyway, then maybe you want to do it in 2025. But I wouldn’t necessarily say, go out spend a bunch of money on a new car, just on the chance that they repeal those credits, because we really don’t know what’s going to happen,” he said.

Another area of potential opportunity is the residential solar tax credit.

“That would just be another one where it’s kind of like, hey, maybe it’s on the chopping block. We don’t know. This administration is not necessarily favorable to those type of green credits,” he said. Brewer added that tariffs on Chinese imports could impact the solar industry because panels tend not to be built in the U.S.

The takeaway: “If you were going to go with solar, claim that 30% tax credit on your 2025 taxes, try to beat the tariffs, this might be a good time to sign that contract and lock in some pricing,” he said.

Brewer also offered a brief summary of an issue that anyone who has formed a corporate entity should monitor or check with their tax professional this spring about: Beneficial Ownership Information Reporting, or BOIR. Most corporations, limited liability companies (known as LLCs) and other entities have been instructed to file a report about who owns the company, but the regulation has been put on hold and is pending a legal determination, he said.

When that happens, the requirement might come into effect.

With tools like LegalZoom, which make forming an LLC or corporation more accessible than it used to be, more people than before may have business entities that could be subject to BOIR, he added.

Planning for next year, now

Looking ahead, some changes are underway for tax year 2025, which means they will be registered on returns that will be filed in 2026.

One change has to do with how the IRS treats inherited IRAs. Based on new guidance released by the IRS last summer, certain people with inherited IRAs will be impacted by a shift that governs when they must take required minimum distributions (RMDs).

Starting in 2020, people (with some exceptions, including spouses) who inherited IRAs have 10 years from the first IRA owner’s death to withdraw all the funds. The timeline starts ticking based on the date of inheritance. And under the recently clarified rules, starting this year they must do this by taking annual required minimum distributions (RMD).

There’s one key nuance: this is the case if the first owner had started taking those RMDs. If the first IRA owner died and had not starting taking RMDs, the 10-year rule still applies but RMDs don’t need to be taken every year.

Typically people have to start taking withdrawals from traditional IRA, SEP IRA, SIMPLE IRA and retirement plan accounts when they reach 73. One exception: IRA owners who turned 73 in 2024 have until April 1 of this year to take their first RMD based on their account balance at the end of 2023. The second RMD is due by Dec. 31, based on the balance at the end of 2024.

A required minimum distribution amount worksheet can be found on the IRS website.

“IRS never really pinged people on it if they didn’t take a minimum required distribution from inherited IRAs,” Brewer said. “But in 2024 they said, ‘Hey, you have to start doing it. Here’s our final guidance. If you don’t do it, we’re going to penalize you.’”

That penalty can be as high as 25% of the required distribution.

The IRS website explains RMD requirements at these two websites:

www.irs.gov/retirement-plans/required-minimum-distributions-for-ira-beneficiaries

www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs#

It’s becoming more common to own an inherited IRA, Brewer added, because of the way retirement finances have changed over time.

Pensions have “kind of gone by the wayside long enough that now, when people’s family members die, a lot of times they have IRAs, which they never really pay tax on. And so it’s more common for people to inherit pretty significant sums in IRAs.”

Brewer shared one more pointer that specifically targets self-employed workers. He urges people to set money aside for quarterly tax payments and to avoid resorting to extensions unless it is absolutely necessary. Failing to do so can cause tax liabilities to “snowball,” he said.

Danny Michael, the founder of Satori Wealth Management, a San Diego fee-only financial planning firm, said there are two more changes San Diegans should plan for. Anyone with a Health Savings Account (HSA) should know that account limits are going up. For individuals, the limit is increasing $150, from $4,150 last year to $4,300 this year. For taxpayers with family coverage, the limit rose from $8,300 in 2024 to $8,650 in 2025, an increase of $350. Catch-up contributions for people 55 and older are unchanged.

Also, people can contribute more to their 401k this year. For people deferring money from their paychecks, the limit is $500 higher. They can now contribute $23,500. The catch-up contribution amount is unchanged from 2024 for people ages 50 to 59 and over 63, with a total possible contribution of $31,000. But one group can catch up more aggressively: people who are age 60 to 63. That limit is $11,250. This brings their max contribution to $34,750, Michael said.

“Studies have shown that many Americans are not saving enough for retirement,” he wrote in an email. “These contribution limits have steadily increased due to inflation adjustments, rising wages and legislative efforts such as the SECURE Act and SECURE Act 2.0 to encourage greater retirement savings for Americans.”

Also for tax year 2025, the IRS has announced how inflation adjustments will affect other deductions, exemptions and credits:

Standard deduction is going up. For single taxpayers and married people filing separately, the standard deduction for 2025 is $15,000, up $400 year-over-year. For married couples filing jointly, the deduction is $30,000, up $800. And for heads of household, the standard deduction is $22,500, up $600.

Alternative minimum tax exemption is going up. For tax year 2025, single people’s exemption amount is $88,100; that is up from $85,700 in 2024. For married couples filing jointly, the amount increases to $137,000, up from $133,300 in 2024.

Marginal rates stay the same in the top income tier. If you’re a single taxpayer with an income of more than $626,350 or a married couple filing jointly with an income of more than $751,600, your marginal rate is 37%.

Earned income tax credit cap is going up. The maximum credit amount is $8,046, up from $7,830.

Note that these changes are typically for income tax returns that will be filed in the tax season of 2026, for earnings in 2025. A list of changes is available on the IRS website: www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025